Computation and the Transformation of Practically Everything: Business and Economics

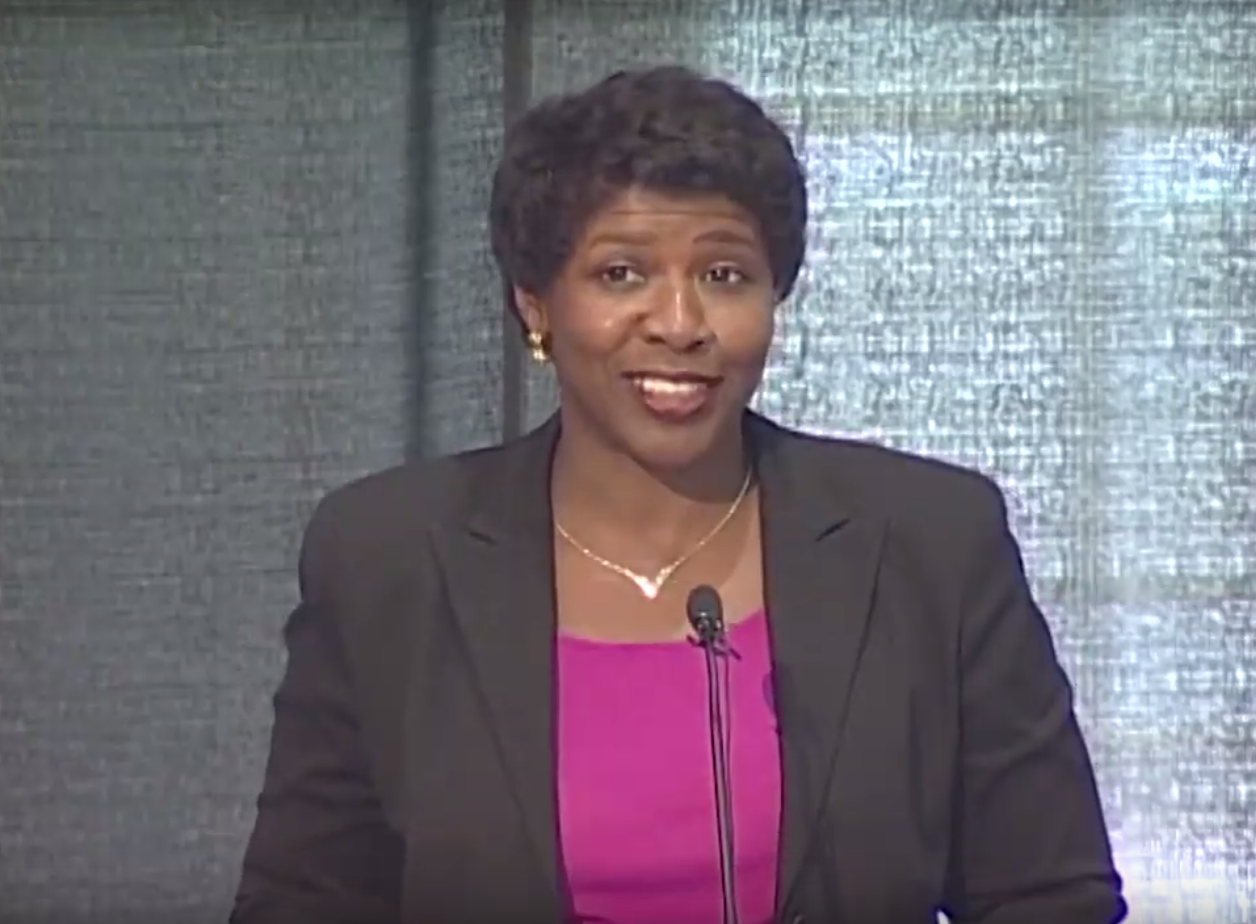

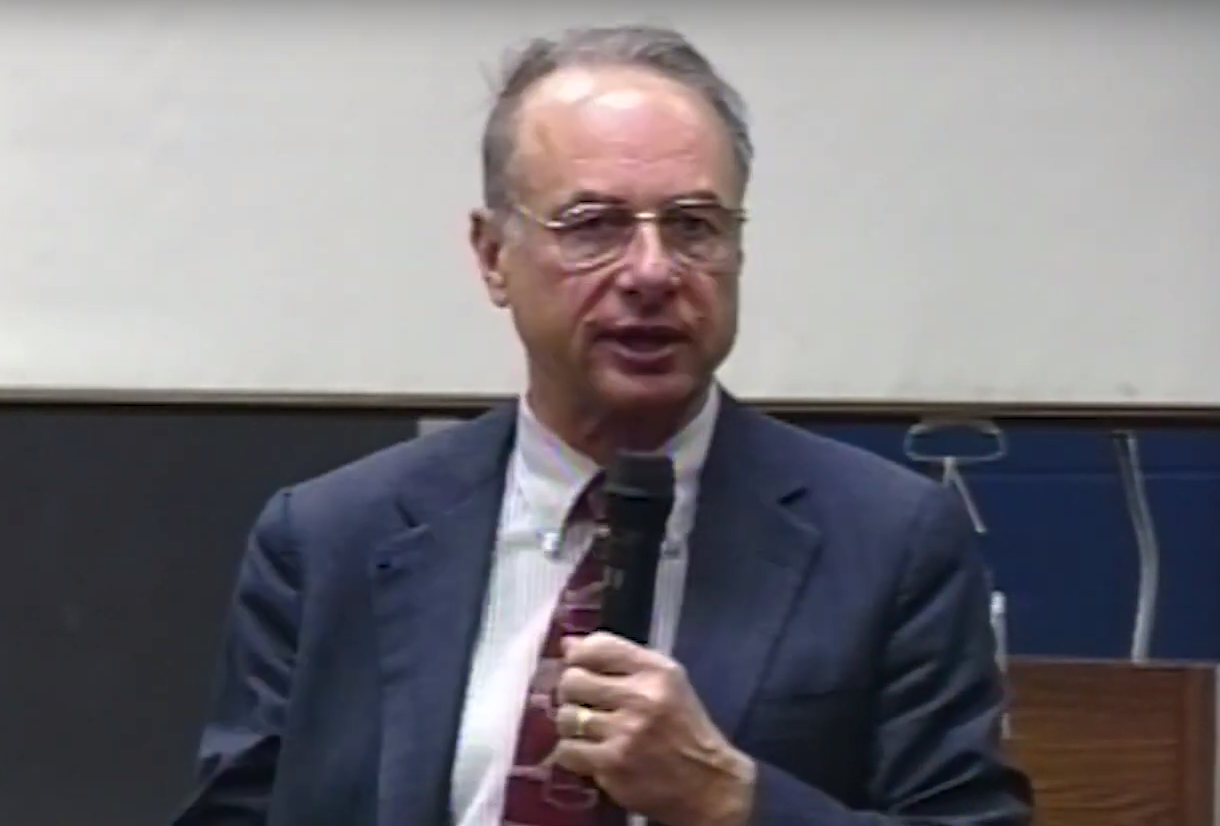

GUTTAG: I want to start by applauding the endurance of those of you who have been here since 9 o'clock this morning and are still here. I hope you have had enough caffeine or whatever your drug of choice is to stay alert, since we're expecting to finish with a very interesting session this afternoon. Our first speaker is Andrew Lo. He's the Harrison Harris Group Professor of Finance at the MIT Sloan School of Management, and the Director of the Laboratory for Financial Engineering. Andy?

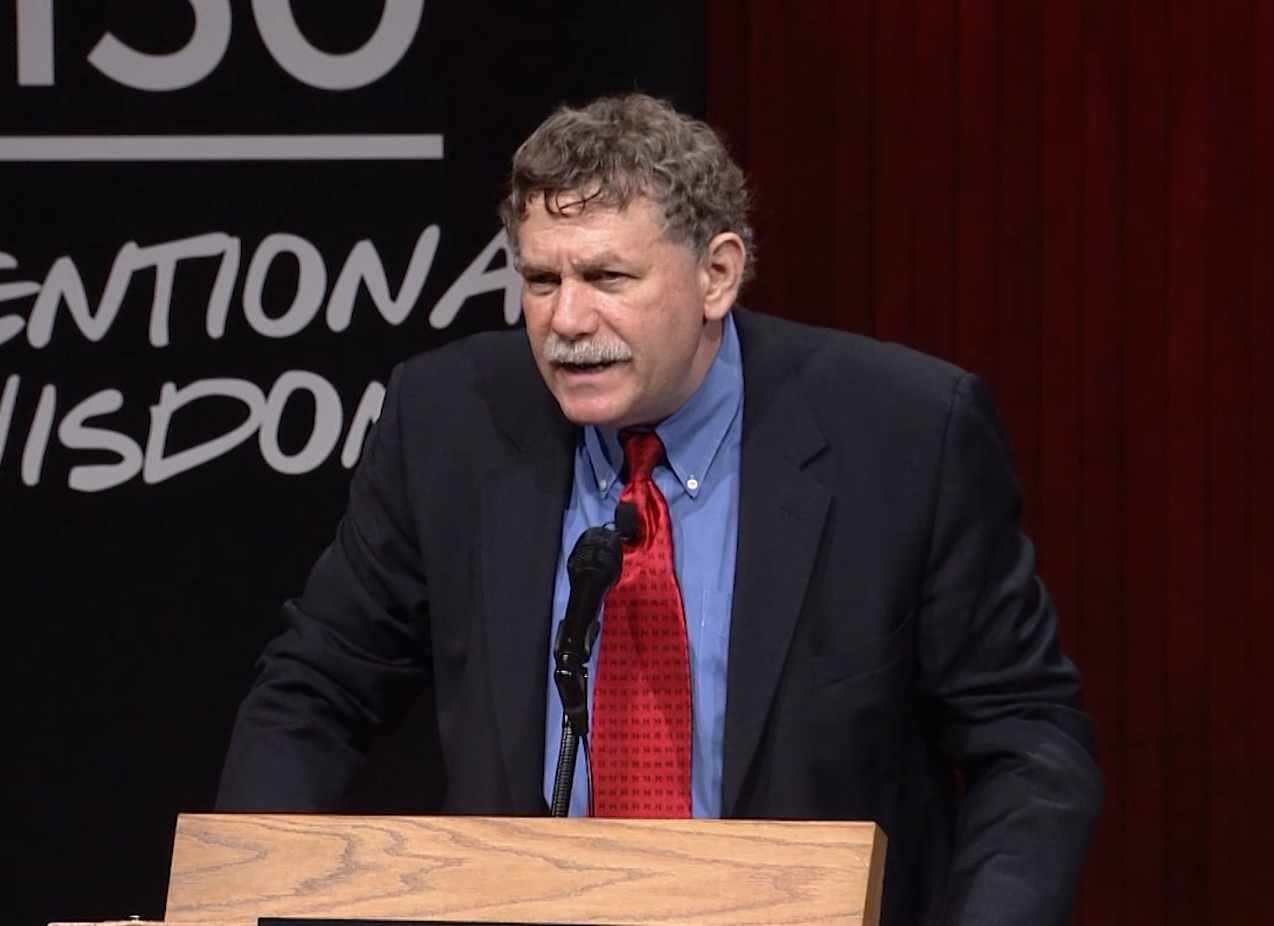

LO: I'd like to start by thanking John Guttag, Victor Zhu, and the other members of the organizing committee for inviting me to participate at this wonderful event. For somebody who's interested in technology, this has got to be like a kid in the world's largest candy factory, and I'm honored to be here. And although you may feel it's a little out of place for somebody from the Sloan School to be here, the title of the session is Business and Economics, so I'll endeavor to talk about that. But I have to say that I'm really relieved that my co-panelist is John Thain, who is a real practitioner. Our students often remind us that those who can't do teach, those who can't teach teach gym, and at least I don't teach gym.

So what I'd like to do is to talk a bit about the evolution of financial technology, and how computation has truly changed everything, including finance. Now let me start very quickly with the evolution of computation, which as you all know began with ENIAC in 1946. And just last year, the world's fastest computer was put online, the Tianhe 1A GPU/CPU hybrid, which now operates at 2.5 petaflops, in comparison to the ENIAC 500 flop machine. For those of you who are not sure what a petaflop is, it's 2.5 million gigaflops. And if you don't know what a gigaflop is, you're probably from the Sloan School, I'll tell you later.

But the point is, that the evolution of computation has indelibly altered the evolution of market dynamics, and let me now turn to that. Markets have evolved, of course, as well. Many of you probably know that on May 17th, in 1792, under a buttonwood tree in the south of Manhattan, an agreement was reached to create a market, an organized exchange. This was the precursor for the New York Stock Exchange that has ultimately become one of the world's largest organized exchanges.

This is a picture from the New York Stock Exchange from a few years ago, and in fact this picture is a bit outdated, because the New York Stock Exchange has grown much smaller than that in terms of floor space. Now, a lot of the trading goes on in the server farms. And in fact, a years ago when the chief operating officer of the New York Stock Exchange was giving a talk, he lamented the fact that a number of hedge funds and broker dealers had been in a bitter dispute with the New York Stock Exchange to see whether they could co-locate their servers a few racks closer to the New York Stock Exchange racks in order to get that additional millisecond of latency reduced. Absolutely true.

Information is now abundant, and also fast. We used to have ticker tapes. Do you remember the ticker tape? And now of course, we have information literally at light speed. And the point is that technology has always been put into practice relatively quickly when there is an economic incentive, and to give you an illustration of that, let me just show you two pictures-- a before and after-- of Wall Street with respect to the invention of the telegraph. Remember the telegraph, the dots and dits and Samuel Morse? Well, here's a picture of Wall Street in the 1920s, before the telegraph was invented, and here's a picture just a few years later.

Now, I don't know how many of you can see back there, but you'll notice that the sky is actually clouded, and these are wires-- telegraph wires. Progress is inevitable when there's an economic incentive, and one of the best illustrations, of course, is e-commerce. If you take a look at the graph of the amount of e-commerce just since the last 10 years, it's been a pretty steady progression of growth, and right now, on an annual basis, we are doing $165 billion of trade online. This is an industry that didn't exist a decade and a half ago. That's truly astonishing.

And that's the same for finance, but I would argue even more so in many ways. Now, finance has some unique characteristics. For one thing, financial transactions are extraordinarily sensitive to both trust and privacy, and it's expensive to implement. Just an illustration of that is JP Morgan's annual income statement and balance sheet. You probably can't see this back there, but on one of the lines is their technology budget for 2010. JP Morgan spent $4.6 billion on technology. Telecommunications, hardware, software. And it's because the nature of financial transactions is quite different than typical electronic types of interactions, in the sense that trust and privacy are considerably more critical.

In contrast to something that Ed Lazowska said this morning about best efforts programming, in financial contexts, if you make a mistake in version 1.0, you won't be around to do the revision in 1.1. And so that means that there's a very important distinction between how technology is rolled out in financial context from other ones, and there is a great demand as a function of the kinds of applications that we've developed.

Let me just describe a few of those applications that have come out from academia. Macroeconometric models, the big, multi-equation models of the 1940s and '50s, was one of the earliest uses of computation. Linear programming, as you all know, is heavily computation oriented. Portfolio optimization, the capital asset pricing model, derivatives, credit models, quantitative equity trading of the 1990s and early 2000s, and then, of course, securitization and CDO models have all contain a very strong computational component.

Without computation, none of these things would have had the impact that they did. And in some cases, the impact has been somewhat questionable, as with the last one. Wired magazine discussed the CDO model as the formula that killed Wall Street, and I'll talk about that later.

But let me spend a few minutes describing a bit more of the successes that we've seen in taking finance and marrying it with technology. And the example that I'm going to use has to do with stock options. Now most of you, even if you don't know much about finance, you probably know what a stock option is. Basically, a piece of paper that gives you the right, but not the obligation, to buy another share of stock sometime in the future.

In the 1960s and '70s, a number of economists attempted to come up with a valuation formula to figure out what it's worth. And of course, as we know, the Black-Scholes and Merton formula really took the industry by storm. They showed that the value of a stock option under certain idealized conditions is the solution to a parabolic partial differential equation with the following boundary conditions, and it turns out that this equation is a transformation of the good old fashioned heat equation, which has a solution. They published this in 1973.

Now, something else happened that year that was quite astonishing. In the same year that they publish their papers-- those are the two cover pages of the Black and Scholes and Merton papers, they published them about the middle of the year-- about the same time, a new exchange was started in Chicago, the Chicago Board Options Exchange. In fact, I believe that John Guttag's father was one of the founders of that exchange.

And that exchange started about the same time. It was launched in April of 1973, and by 1975 this exchange started engaging in computerized price reporting, they created an options clearing corporation in order to intermediate counter-party risk, and last but not least, they adopted-- officially adopted-- the Black-Scholes formula to price options.

Now something else happened, though. It wasn't just that the exchange was started. At the same time, computation made some pretty important advances. And what I'm focusing on, in particular, is the calculator. Now I don't know how many of you recognize this. I had to dig deep in order to find this advertisement. This is an advertisement for a TISR-52 programmable calculator. It was available-- they started to market it in 1974. And I have it on good authority-- in particular, John Guttag, who at that time was actually programming the Black-Scholes formula on these calculators, using those little magnetic strips, for traders on the Chicago Board Options Exchange.

It was really the confluence of computation and the financial technology that exist at the same time that really created this huge industry. Now, the TI cost $400 in 1975. That's a lot of money-- $1,600 by today's standards-- but when you think about the cost of a bad trade versus the profits of a good one, this was nothing compared to the benefits that would accrue. And of course, the rest is financial history.

If we take a look at the volume of trading that occurs now in options-- starting from 1973, where during that very first year, about a million options contracts were traded over the course of the year-- as of 2010, we had over 3 and 1/2 billion contracts traded each year across a variety of different exchanges. Of course, Scholes and Merton received the Nobel Prize for their work in 1997. Fischer Black had died by that time, otherwise he would have surely shared in that prize.

And in 2000, a fellow by the name of Bill Porter, an MIT Sloan Fellow grad from the class of '67, the person who launched eTrade, the electronic broker dealer, also launched an options exchange called the International Securities Exchange. It was the first all-electronic options exchange, and less than a decade later, that options exchange now has the same trading volume as the Chicago Board Options Exchange. It's really quite remarkable, the impact that technology has had.

Now we've all benefited enormously, and if you take a look at your Vanguard website-- this is my website-- it turns out that we now can trade options, stocks, ETFs, any number of securities, literally at the click of a mouse. And if you look at the transactions costs of typical stock transactions, it's incredibly inexpensive to do these trades. That's one of the benefits of technology.

Let me now turn to some of the unintended consequences of technology. I think this is a theme that runs across all technologies, not just computation and finance. And to make the point-- given that we have a limited amount of time, I don't want to spend too much on the financial crisis-- let me show you one graph that I think encapsulates some of the issues that we've been dealing with in the financial industry. This is a graph that represents an index of housing prices-- US residential housing prices-- in the United States, from 1890 to the peak of the housing market in 2006. And these are real prices, in the sense that they're adjusted for inflation, so you can compare across time.

And let me just ask you, does anybody notice anything unusual about this graph? You don't need a very sophisticated machine-learning algorithm to tell you that the last 10 years have been an outlier. And in particular, the extraordinary run-up in housing prices over the last decade, and of course their subsequent drop thereafter, can be traced to the confluence of human behavior interacting with new financial technologies. Technologies that allow us to pump tremendous amounts of money from various aspects of the global economy into residential real estate.

Now, the real estate market has obviously had its ups and downs during the course of the crisis, but it's had some remarkable ripple effects, and I want to give you an example of a couple of those ripple effects, one of which was referred to this morning. During the second week of August, 2007, a very narrow slice of the financial industry was tremendously adversely affected. And in particular, it was the quants-- the quantitative equity market-neutral managers-- that all seem to have lost money at the same time, during that second week of August. And because these quants were engaged in relatively secretive kinds of trading strategies, it's very difficult to figure out what happened, but thanks to the miracle of computer simulation, we've been able to come up with a couple of strategies that have the same kind of loss of wealth during that period of time, so we're actually able to figure out what happened.

And again, through those analytics and through computation, we're actually able to simulate the so-called Quant Meltdown of August, 2007. So here's a little video clip that actually illustrates it. Before we run the clip though-- whoops-- let me just show you what you're going to see. If we take a look at the left side of that graph, that's going to be a chart that represents the volume of trading in S&P 500 stocks. The right panel is going to represent the return, over five-minute intervals, from the beginning of July 2007 to the end of September 2007. And these are five-minute increments for 500 stocks. The way that they're arranged is with the smallest capitalization stocks to the left of those panels, all the way going to the largest companies on the right of those panels.

So now, could we just play this clip? If you can take a look at it, you'll see some interesting patterns that emerge over that three month period of five-minute returns. So now we're entering the middle of July, and towards the end of July you're going to see something happen, right before the beginning of August. You see, the color is telling you that there is more and more trading of the smaller stocks on the left. Now here we go, into the beginning of August. And the second week of August is there, and there we go. Boom.

That huge event was where all of these stocks became highly correlated, all at once over the course of a three day period, causing massive losses in these quant equity funds. If you look at the left hand side, you can see that there's tremendous volume in certain parts of the market, but not in all parts. And in September you're going to see another big bump, as there's a tremendous recovery that is also highly correlated across these companies.

OK. That's it. That was August, 2007. Let me show you what happened on March 6, 2010. On March 6, 2010, the quant meltdown had a repeat, but instead of taking a week to replay, what happened over the course of the week occurred in approximately 13 minutes on August 6, 2010. That was the Flash Crash that Tom Leighton referred to this morning, where from 2:20 to 2:45 in the afternoon, companies like Accenture, which was a $35 billion company in the morning, was worth approximately a million dollars in the afternoon. And then of course, it became worth $30 billion again afterwards.

Now, you would think that somebody was just joking. Maybe somebody pulled the plug to all the systems on the New York Stock Exchange just for a half an hour, for fun, but this kind of an event is something that we expect is going to happen more frequently, not less. There were early warning signs, and the early warning signs were things that you can come up with relatively simple tools, if you were looking for them.

In some research that I had done with a couple of EECS students, Shane Haas and Nicholas Chan, and a System Dynamics student, Mila [? Getmonski ?], in 2004, we actually used some pretty basic signal processing techniques, applied to the hedge fund industry, to show that in 2004, the hedge fund industry was getting too illiquid, too much leverage, and was really heading towards some kind of a major dislocation. We were asked by the conference organizers to come up with a bottom line, and so the way we decided to make the point was to use the Bulletin of Atomic Scientists' Doomsday Clock to see how close we were to a financial catastrophe. At that time, we said it was about a quarter to midnight in 2004.

The New York Times actually picked up on our research, and in September of 2005 they wrote about it. And in the last paragraph, the reporter wrote that the nightmare script for us would be a series of collapses of highly leveraged hedge funds that bring down the major banks or brokerage firms that lend to them. And in 2005, that seemed like an absurdity, but of course in 2007 a number of those situations played out, as we saw.

The bottom line is that the financial network is becoming much more complex, and the nature of the relationships and the transactions are that much tighter. This is a network graph from a piece of research that some students and I have done. I'm looking at causality networks across four different institutions: banks, broker dealers, insurance companies, and hedge funds. That's what the different colors mean. Each color corresponds to a different type of financial institution.

And this network, which really graphs the connections of statistical relationships among these four types of entities, this is a network that existed prior to 2008. Take a look at the density of the graph between this, and this is where we are in 2008. It's a much more tightly coupled system, and so some of the research that we're doing now, jointly with [? Monsoor ?] [? Dalla ?] in the EECS department and with students in applied math and the operations research center, we're trying to map out these networks to understand how it is that the computational powers that we have at our disposal can be used to understand better where our exposures are.

Since I'm running out of time, let me conclude by saying that computation really has transformed everything, including financial markets, and there's no doubt that we're vastly better off. But the problem is that the unintended consequences are now coming to roost, and that there are systemic risks that exist today that did not exist before we had access to these technologies. The analogy that comes to mind is that we used to do things with a hand saw, but now we've been given a chainsaw. And it's tremendously powerful to use that chainsaw, but we need to know what we're doing.

I use that analogy because a few years ago, when my seven-year-old was having a birthday party that we were planning for him, we asked him what kind of party favors he would like to have, what kind of theme. Would he want water balloons, or little rockets? And he said that he saw our neighbor a couple days ago using a small little chainsaw, trimming the hedges, and he'd really like to have a few of those as party favors. Now for a split second, the image of 10 seven-year-olds chasing each other with chainsaws came to mind, and then we said no.

But if we think about it, this is the point that we are at right now. We have tremendous power at our disposal, but we also have the ability to wipe out a large part of our life savings at the click of a mouse. We can do better. We have to do better, and really, technology has to account for the frailty of human behavior, and I believe that MIT and computation can play a critical role in this. Thank you.

GUTTAG: We have time for a few questions. Maybe I'll get the ball rolling by-- since you were so prescient earlier, could you please tell us, what's the next crisis we should be worried about?

LO: I'd be happy to do. The kind of crises that we see building right now have to do with, again, increasing leverage, potential for dislocation, and a lack of attention. And so the areas that are building are in commercial real estate, in sovereign debt, and to a lesser but potentially significant degree, in a small and mid-size banks that make loans, particularly to municipalities. Those are areas that I think still need a lot of analysis and transparency in order for the market to really fully appreciate the potential for dislocation.

But the more general theme is that anything that sets people off and creates a panic, a loss of confidence, a loss of trust, is something that I think is ripe for a potential disaster, and I think that's really the way we have to start looking at it now. We have to start looking for the areas where those kinds of lack of confidence can actually emerge rapidly.

GUTTAG: But with the world as complex as you've shown us, is transparency even possible?

LO: Well you know, that's a great point. And frankly, that's something that got me very excited about something that Shafi Goldwasser concluded her talk with. Most of you were probably focused on other parts of her talk, but the result that she closed with, the ability to engage in computation with encrypted data, is actually a tremendous breakthrough for the financial system because one of the things that actually made it very difficult for us to understand the systemic risk exposures that existed in the economy in the early 2000s was not only lack of data, but the lack of willingness to share the data.

If I'm playing poker with you, the last thing I want to do is tell you what my hand is and have you tell me what your hand is, because then that's not much of a game. But what if that's the case, that we're playing a game and we can share information about our collective exposures without having to give up our hands? That sounds a lot like what Shafi was talking about at the end of her talk, and that's only been solved as of, I think, 2011. That was the reference that she gave.

So imagine if we could actually collaborate, coordinate, and cooperate on all of these kinds of activities, without necessarily having to provide full disclosure as to what our positions are. Then we can actually measure the risks without having to give up our competitive advantages, and I think that will make the world a safer place.

GUTTAG: Thank you.

LO: Thank you.

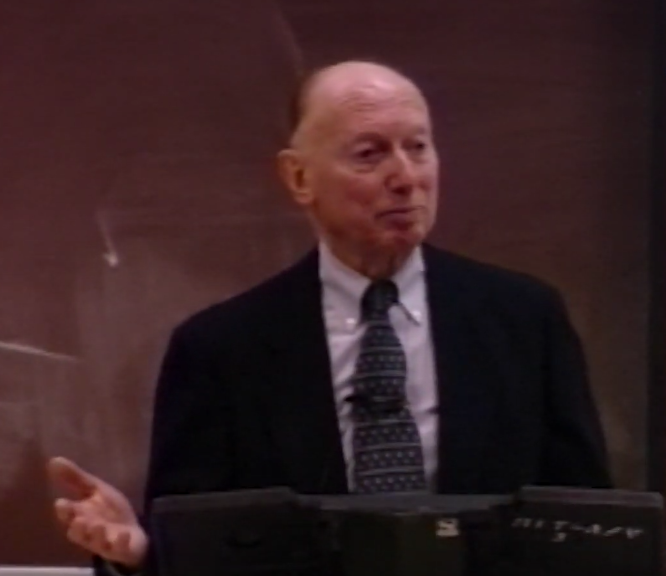

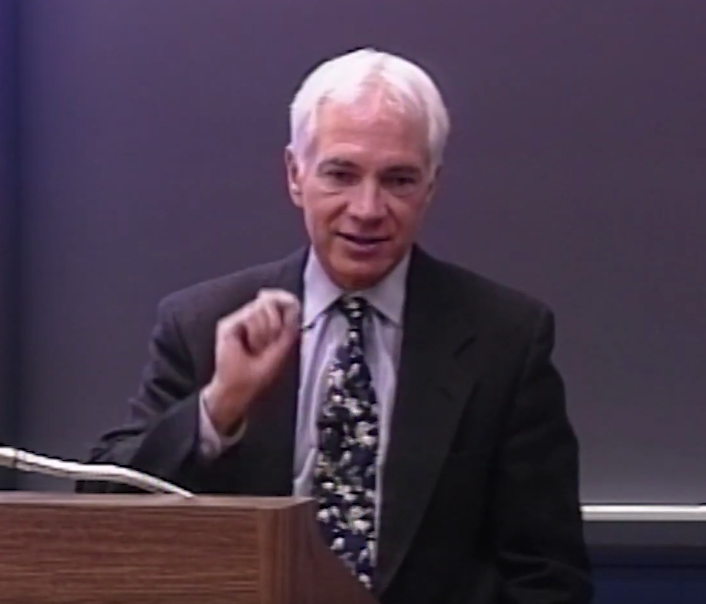

GUTTAG: As Andy intimated, or even stated, our next speaker is not an academic but an experienced practitioner in the treacherous shoals of finance. John Thain, an MIT graduate, currently Chair of the EECS Visiting Committee, but he's here today because he's Chairman and Chief Executive Officer of CIT Group, Incorporated. John?

THAIN: Thank you very much. It's a pleasure to be here, and it's also pleasure to be on this panel with Professor Lo. As he started, he said that those who can't do, teach. But at least over the last several years following the financial crisis, I think it would have been a much better place to be teaching. It's been a difficult environment in the financial world.

But if I go back to when I graduated from MIT in 1977, it's a little bit hard to imagine that in 1977 there were no smartphones, there were no iPads, there were no personal computers. And if you were looking someone up on Facebook, it meant you were looking at a physical book, with pictures. So as you heard from Professor Lo, the impact on finance over the last 34 years of computation and the changes in computation capabilities has been tremendous. And whether it's the trading of stocks, which I'll talk a little bit about, or derivatives such as options, the ability to create, and at least theoretically, price, very complex securities, the areas of risk management and their occasional failures, the ability to do complex financial analysis, and the availability and the organization of market data are all just a few areas that have undergone tremendous change.

But despite all of the advances in technology and computational capabilities, human judgment still matters and garbage in still results in garbage out. So I'm going to take a few examples over the course of my career, and talk about how things have changed, about how human judgment and the inputs to model still make a very big difference.

When I started at Goldman Sachs in 1979, I never had to call tech support for my computer problems. That's the good news. The bad news is that we analyzed financial transactions on large sheets of green paper, with lines and columns, and we did the calculations by hand, and I don't even think we had SR52s. My assistant at the time, who actually happens to still be with me, would type the spreadsheets on an IBM Selectric typewriter, which you can find a picture of some place on the web. And we got stock prices from green-screened Quotrons. I wonder how many of you know what a Quotron even looks like. And when we needed to make changes, we literally cut and pasted the pieces of paper.

I remember one of the merger transactions that I worked on, where we were looking at 12 different structures. All cash, all stock, part cash, part of convert, with 12 different prices. That's 144 sheets of green paper. So I don't know if Microsoft Excel and PowerPoint have made the lives of financial analyst any better, but they're certainly a lot more productive today. But even today, none of the Excel spreadsheets or PowerPoint presentations will tell you whether or not a transaction is good for your shareholders, and you still have to make sure that the numbers are right.

As Professor Lo said, probably no other place in the financial world has been changed more by computation then the trading of stocks and in the trading of options. As you probably know, one of my jobs was the CEO of the New York Stock Exchange. In 1977, the average daily trading volume on the New York Stock Exchange was 21 million shares. Today, then New York Stock Exchange trades over 2 billion shares a day. It would have been impossible for that to happen-- to trade that many shares, and to actually clear and settle them-- with the 1977 technology. So just the sheer ability to trade huge volumes has made a tremendous difference.

And when I joined the Exchange in 2004, the average time to execute a trade was measured in seconds. Today, you can execute a trade on the New York Stock Exchange in less than a millisecond. And to put that in perspective, the blink of an eye is about 300 milliseconds. And professor Lo alluded to this, but this is actually true. Traders now do, in fact, co-locate their trading engines next to the Exchange's execution computers to reduce the speed of light delays caused by the distance an electronic order has to travel. So they really do do that.

But this electronic execution is not always positive. If you enter the trade incorrectly, the outcome can be very expensive. Several years ago, Mizuho intended to sell one share of a company named JCOM on the Tokyo Stock Exchange for 610,000 yen. Instead, they entered the trade as sell 610,000 shares, at one yen. That error cost Mizuho $225 million.

Now, you can put input filters so you can't input a share price that's too far away from the last share price, and you can actually limit the volume you can put in for any one trade, but people are very creative when they come up with ways to make mistakes.

And so a couple years ago, someone put in a trade to sell Pfizer's stock at the market, and they put in to sell 500,000 shares but they really wanted to sell five million. So they said, well, duplicate the trade 10 times. Unfortunately, when they did that, they duplicated the trade 1,000 times. And that, actually, is very hard for the input filters to catch, because each trade looks OK. But what actually happened on that particular day, because the orders went to the floor of the stock exchange, the specialists-- which still are there-- they saw this incredible number of exactly the same orders coming in, and they actually said, wait a second, there's got to be something wrong here. And they actually went back to where the orders came from, and were able to cancel those orders.

Now most recently-- and I want to talk about the Flash Crash for a second, because there's a very interesting element of what happened in the Flash Crash. The lack of human intervention, and the lack of market-wide rules on individual stock's circuit breakers, also contributed to the Flash Crash. I don't know if you can see on the graph, but where the stock of one company which Professor Lo alluded to, Accenture, Accenture traded from $40 to one cent in a very short period of time on the electronic markets.

But that was at least in part due to the fact that the stock exchange has circuit breakers for individual stocks, and the rest of the purely electronic market doesn't. So when the Exchange implemented the circuit breakers, all of the trading volume went to the purely electronic markets. And I think Mary Shapiro, who was testifying in front of a congressional committee, said it best. Mary Shapiro is the Chair of the SEC. She said, "Automated trading systems will follow their coded logic, regardless of outcome, while human involvement would likely have prevented these orders from executing at absurd prices."

Now, it's interesting. Of the 15,000 trades that were canceled following the Flash Crash no trades were canceled on the New York Stock Exchange where the human specialist still monitor the trading of stocks. So I think clearly, human judgment still matters.

My third example involves the creation and pricing of complex securities. I had the great honor to work with Fischer Black when I ran the Mortgage Securities Department for Goldman Sachs in the mid-'80s. Now, mortgages are complicated securities to begin with, because they contain an embedded option. If I'm a homeowner and I have a 6%, 30 year fixed-rate mortgage, and interest rates go up, I'm very happy to pay my principal and interest over the next 30 years. But if I have that same 6% mortgage and interest rates go down to 4 or 5%, I decide to repay my now three month duration 30 year mortgage, and take out a new 30 year mortgage.

So this optionality causes the pricing of mortgages to be more complicated than a lot of other fixed income securities, particularly because some people pre-pay their mortgage even when it's uneconomic, because they move or they want to buy a bigger house. And then some people actually don't pre-pay their mortgage, even when it's economic for them to do so. So we then take all these mortgages, and we put them into big pools, and we can model them and price them as interest rates change.

And even back in the '80s when I was in the mortgage area, we took the cash flows from these mortgage pools and we sliced them and diced them in terms of both time and credit. And I want to give you an example, a simplified example, of how a credit tranching might work.

So what you do is you take the lowest credit quality piece of the pool, and you say, that piece will absorb the first 10% of any principal losses in the pool. And that piece is generally considered as an equity type piece. And then you take the next piece, which would typically be-- you could get it actually rated, up until the financial crisis, you could get it rated single A-- and the second piece would absorb losses between 10 and 20% of the pool. And the last piece would absorb losses over 20%, and it would be rated AAA.

Now, this worked reasonably well when mortgages were 80% percent of the value of the house, and it worked reasonably well when the borrower actually had a job, and it worked reasonably well when home prices were rising. It didn't work very well when the mortgage was 100% or more than the value of the house, and the borrower had no income, job, or assets-- they actually had a name for those, they were called ninja loans-- and home prices started to fall.

Then, some genius-- not from MIT, probably from Harvard-- decided to collect a pool of these single A pieces, which were already created from the pools of these mortgages, and create a new pool called a CDO. And more and more of the mortgages that were underlying these single A pieces became these 100% ninja loans. And then they threw a few other types of collateral into this pool, just for good measure, and you then created an extremely complex security.

Now it actually was possible to price these securities if you had a very sophisticated model, created by many MIT PhDs, and you had a very fast and powerful computer-- think Cray. However, my recommendation to buyers of these securities is, if you don't have a very sophisticated model and a very fast and powerful computer, it's not a very good idea for you to be buying things that you don't understand. That advice would have saved a number of German, Icelandic, and US banks a lot of money.

The second problem with these securities was all of these sophisticated models had an important assumption built into them. It was called HPA. It stood for home price appreciation. The idea that the number could actually be negative was not even considered at first, when these models were developed. So I'll let you do the math on that piece that absorbs the 10 to 20% of the losses in the pool, of what happens to that single A piece if home prices fall 40% and half of the borrowers default. It's not pretty, and it wasn't pretty in the financial crisis for people who owned those securities.

So what you had here was a breakdown in judgment, in that you shouldn't be buying very complicated securities you don't understand, and also a failure to use realistic inputs. So even though there has been a tremendous amount of advances, and a tremendous amount of computational capability has fundamentally changed and advanced the world of finance, I want to conclude with a quote by Robert McNamara. "A computer does not substitute for judgment any more than a pencil substitutes for literacy." Thank you very much. I'll take a few questions.

It's very hard to see from up here, but I'll take some questions from the audience if I can see them. Or, you can come up to the microphones.

GUTTAG: Please do come to the microphone.

THAIN: There's one here.

AUDIENCE: [INAUDIBLE]

THAIN: I'll repeat the question, even though I won't actually answer the question. The question was, who should acquire the New York Stock Exchange, or should it remain independent? There has been a tremendous amount of consolidation in exchanges because, if you think about them, once you have all of the computer system to run an exchange, if you can just push more volume through them they become much more efficient. So the more and more volume you have on any exchange, the more efficient it is. And so there is a tremendous logic to having exchanges consolidate, and that was actually true when I was there, when we combined the New York Stock Exchange and Euronext, which was five of the cash exchanges in Europe as well as the futures exchange in London.

The New York Stock Exchange is still going to be there. The New York Stock Exchange is still going to be the primary marketplace for the trading of equities in the United States, and it's combination with Deutsche Börse or whatever else happens to it is simply a consolidation on a global marketplace that, frankly, makes lot of sense.

AUDIENCE: [INAUDIBLE]

THAIN: Well I'm a little bit biased, because when I was there we bought Euronext. The New York Stock Exchange is primarily a cash market. With Euronext, we acquired life, which is a futures market. The futures business is a much better business than the trading of cash equities, because the futures business is much less competitive. So you can trade a New York Stock Exchange listed stock probably in 40 different place today, whereas you can only trade a futures contract that's issued by the CME in Chicago, you can only trade it on the CME. So the futures businesses tend to be much better businesses, and so those companies trade at much bigger multiples and have much bigger market values. And so Deutsche Börse, the big piece of it is called Eurex, which is the European futures business, and they're just bigger and they earn more money and have a bigger market value. But in the end, the merger's going to be more of a merger of equals.

AUDIENCE: [INAUDIBLE]

THAIN: That's a very good question, and it's a complicated question to answer, and I'm sure Professor Lo will have views on this as well. I'll give you kind of an abbreviated answer, because it is complex and the real answer is, there's plenty of blame to go around a lot of different places.

I think the fuel to the graph that Professor Lo showed on housing prices started with the Fed and with monetary policy. Interest rates were too low for too long. That allowed too much leverage to develop in a lot of different places. The consumer was too leveraged, there was too much leverage in the housing market, there was too much leverage in the financial institutions, and there was too much leverage, actually, in the private equity space and in securitizations as well. That leverage drove up house prices, as you saw, to unrealistic levels. The mortgage origination process was flawed, because the people who were originating the mortgages got paid for the origination, no matter how lousy the borrower was or whether the borrower actually could make the payments on their mortgage. The mortgages were then securitized and sold into the marketplace where the originator wasn't keeping any of the exposure, and so the market was absorbing the risk. The rating agencies rated them in ways that made no sense, so that the ratings of the securities didn't reflect the real risk in them. The regulators didn't do their job, either in terms of regulating the financial institutions or the securitization market.

And it's certainly true that Fannie Mae and Freddie Mac, and the policies that they were promoting, which were also promoted by Congress, exacerbated this by really promoting the idea that all Americans should own a home, whether they can afford it or not. So there's lots of blame to go around, and that's kind of a quick summary. But it's complicated, and there are lot of interactions in the things that I just said that exacerbated the problem.

AUDIENCE: When will brokers go extinct?

GUTTAG: The question is, when will brokers go extinct? You made a compelling case for the importance of keeping humans in the loop. Do you think that's possible, or eventually is it all going to go closed loop, and humans just will be too slow to think about including them?

THAIN: Well, I think in many markets it is already purely electronic, and I think that's dangerous. And I think that not having any controls in the system-- and the controls can be electronic as well-- but it's hard to be thoughtful enough to exclude human judgment. So I think it's very dangerous to create systems that have no human input to them.

GUTTAG: It's dangerous. That doesn't mean it won't happen.

THAIN: That's true. I agree with that. And as things trade faster and things are more interconnected, it's harder and harder for humans to interact.

GUTTAG: I think we have time for one last question.

AUDIENCE: Back in the good old days, smart people would start a company and they would go public, and it would go up many-fold. Think Intel, Digital Equipment, whatever. Nowadays, they don't seem to go public. They're taken over by Google or whatever, or like Facebook, they're not going to go public until they're worth $100 billion. The opportunities aren't there for the small companies, and for people who are smart and lucky. Do you have any comments on that?

THAIN: Yeah. I don't agree with the way you phrase the question. The opportunities are there. There are many companies being created, many of them by MIT graduates and by MIT professors, so there are a great many opportunities to start new companies and to grow them. There is somewhat of a tendency to not take them public right now, because it's very expensive to be a publicly traded company. There's a tremendous amount of bureaucracy and regulation right now.

AUDIENCE: Sarbanes-Oxley?

THAIN: Sarbanes-Oxley, absolutely. So there's a lot of disincentives for those companies to become publicly traded companies, but it's not true that those companies aren't being created. There are lots of them, and one of their alternatives is to get bought by bigger companies, but that doesn't take away from the entrepreneurial spirit that creates them, and I think that they are in fact being created.

GUTTAG: Thank you.

THAIN: Thank you.