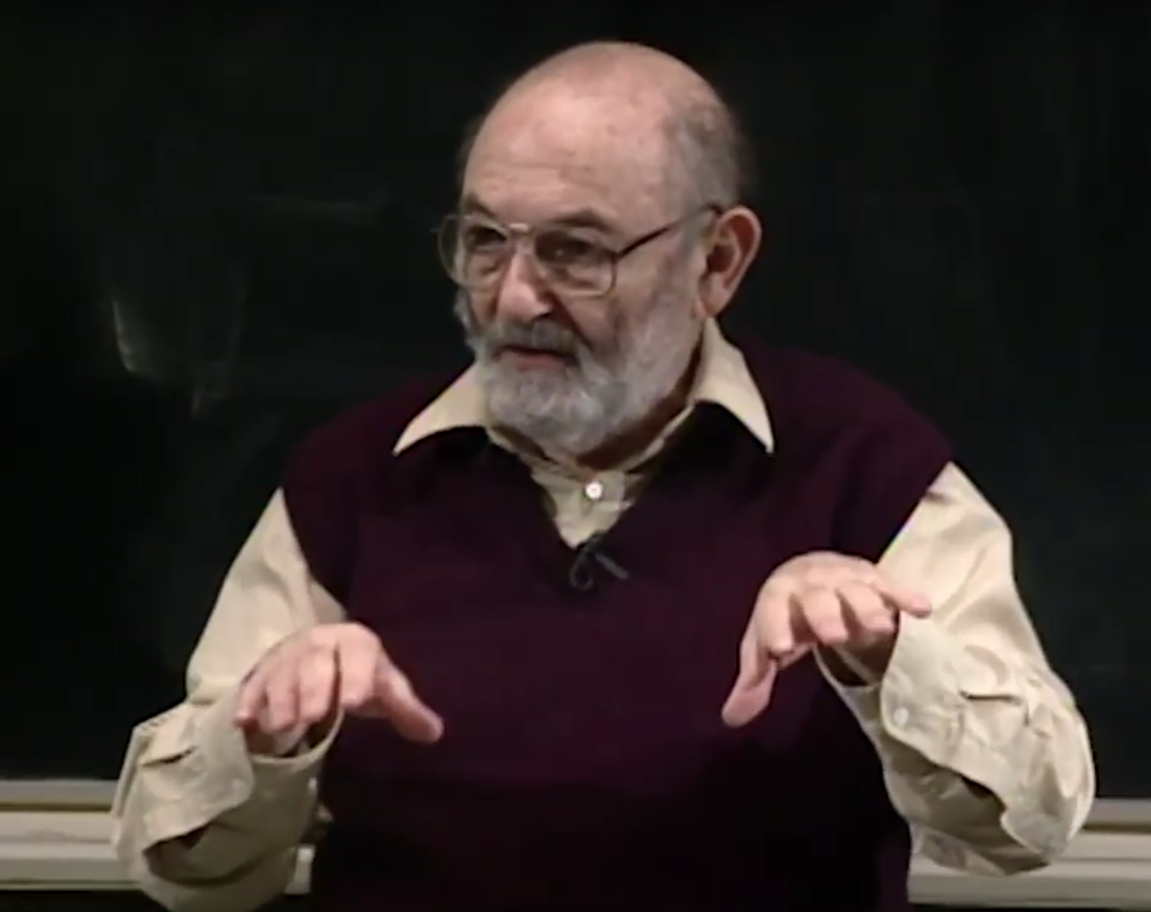

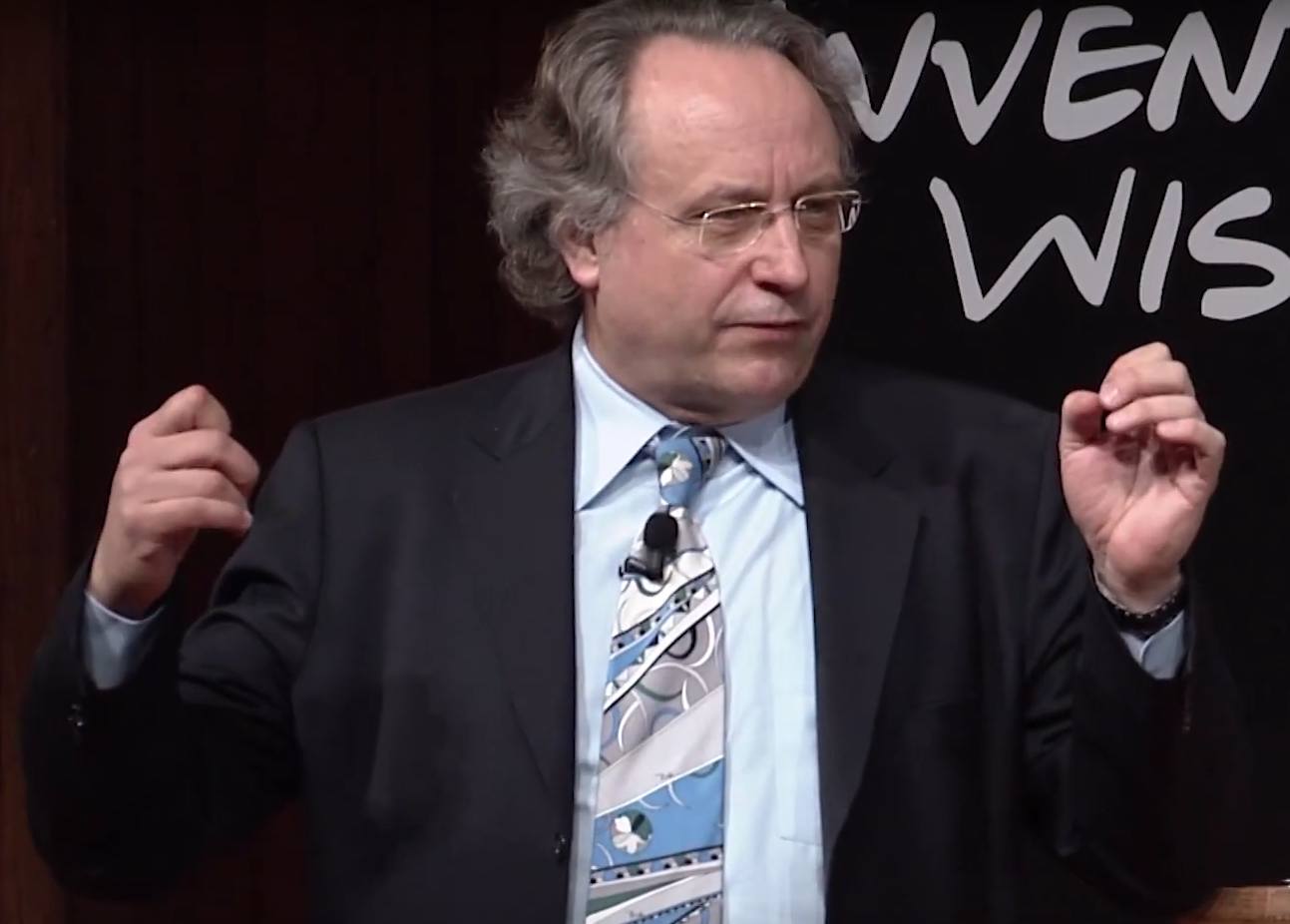

Franco Modigliani, "Italy and 20th Century Economics" (Lect. 2) - Nobel Laureates Lecture

MODIGLIANI: The present situation [INAUDIBLE] looks like this. In many ways, as I already indicated last time, the economy is very strong. It is very productive. Productivity has grown rapidly. And, at the present time, all the major troubles of Italy have, in fact, been fixed.

Now, if you remember, I mentioned the following problems. I mentioned inflation, unemployment, deficits in the balance of payment, government deficit, corrupt government, and bad government. The only one of these problems that has not yet been fixed is unemployment. The others have been fixed, but people don't understand it, and therefore they haven't been fixed.

Now, specifically, what has not been fixed, according to the way people look at it, is the deficit. The Italian deficit, according to the latest program, which was adopted, financial program, which was adopted this year, the current deficit is somewhat above 7% of GDP. And it's programmed, hopefully, to come down, but slowly, so that, by 1996 or 1997 it would still be in the order of 4%-- 3 and 1/2%-- something like that.

And that means that, in terms of this program and these figures, Italy could not possibly enter Maastricht in time, because Maastricht has certain parameters, certain requirements. The deficit must be less than 3%. The inflation must be not more than [INAUDIBLE] no more than some small number above the lowest inflations. You look at the lowest, and you cannot be higher than some fraction of that. The three lowest, I think. Similarly for interest rates. You cannot be more than some margin above the three lowest interest rates.

And these are the only parameters, because, as we know, Maastricht parameters do not include the only one that should really be there, as Lucia and I agree. That is, there should be a parameter for unemployment. You should not enter if your unemployment is more than 5%. okay?

But that parameter does not enter Maastricht. The only thing that matters is inflation, and employment no one cares. That's no problem. No German problem. It is, of course, now, but still they insist that they don't care. The central bank policy can only be directed toward keeping down inflation. No other thing matters.

So, of course, unemployment is also high, so that, even by that standard, [INAUDIBLE]. But it could not enter on any one. And, of course, the remaining requirement is that the deficit be less than 60% of GNP. 50% or 60% of GNP. In Italy, that ratio is 1 and 1/4-- so, way out of the [INAUDIBLE].

Now, essentially, the key point is that the reason why seems to be so far away, I mean, the key parameter in this is the government deficit. Okay? The 7% deficit, as against the 3% requirement. So that, if you now ask, in Italy, what are you going to do about it, you have two lines of reply.

One is, we just cannot meet Maastricht. We'll not enter Maastricht. We'll be second in the class, and we'll enter later-- god knows when. God knows when, because, if you don't enter, that makes the problem of entering more difficult. Because then the exchange rate will be unstable, and interest rates will be high, and with high interest rates the deficit will keep being high.

So a major problem is the deficit. And that high deficit is purely fictitious. It's not there. It's because the official way of calculating the deficit, by German diktat-- the Germans are the powerful. No matter how stupid they are, whatever they say is it. By German diktat, you must know anything about inflation accounting. You must not know that, when you have inflation, the way to calculate the burden of the debt is to include as in income the gain you make, because, as a debtor, your debt loses value.

That is exactly an income that offsets the high price you pay for interest when there is inflation. Interest rates go up, because the debtors lose the inflation. Therefore, they get that much more. I mean, the creditor lose, to the extent of inflation. Therefore, interest rates go up, to compensate for the fact that they are losing.

So, if they were gaining 5%, and now there is 10% inflation, they get 15%, of which 10% compensates for the [INAUDIBLE] loss, and they're left with 5%. But then the government that's being fined, you should agree that, of that 15% that it pays, 10% is made up by the fact that it has an income which corresponds to the loss of the holders. The loss of the holder-- that is the gain of the government. Okay?

You must take it into account, in a government budget. And it is not. Therefore, it appears they have the huge deficit.

Now, correcting for inflation means you should subtract, from the deficit, the product of the inflation times the size of the debt. Or, if you want to look at the deficit-income ratio, then you must take the rate of inflation and multiply by the ratio of the deficit-- or debt to income. The debt to income, let's say.

So, at the present time, inflation is approximately-- I think the last figures are around 4, but it has been around 5. The last figure's 4 and 1/2?

[INTERPOSING VOICES]

4 and 1/2? Yes. 4 point--?

5.

4.5, yes. It's been around 5. interest rates, therefore, are essentially 9 and 1/2, when in Germany they are below 4. The differences is, first of all, the inflation, and then a little more than that because of the exchange risk, which adds some additional points. Which would disappear if you would enter Maastricht, because then there is no more exchange risk, because then your exchange is fixed. Okay? And presumably the countries will help each other to maintain exchange risk-- I mean, to retain the changes.

So, if you figure things right, Italy is the only country now that has zero deficit-- the only country. And that this is not a fiction can be seen in another way. By looking at the so-called primary surplus, which is, the-- the difference is that part of the government earnings, of the government receipts, above the payment of the interest. In other words, take out of the government budget the payment of interest.

And you will find that, in Italy, there is a surplus of 30%. That is, current receipts exceed current expenditure without interest of 30%, which no other country in Europe gets even close. Okay? Even though their real rates may not be very different from Italy.

So Italy already has made the gigantic effort by creating this enormous primary surplus. And, with that enormous primary surplus, it can very easily pay the interest, the real interest, and still have a balanced budget. In fact, it already has a balanced budget and is the only country in Europe that in fact has a balanced budget. The other countries haven't created the primary surplus that's necessary. So all of them are behind Italy, in this respect. But they don't recognize it, because they don't know how to calculate.

I have been telling Italians, Germans, and all the rest how to compute the deficit when there is inflation. Okay? And I've been citing tax and sources. I mean, that is not my intention. Anybody that studies inflation accounting knows the debt is the first principle.

There are five or six major biases that inflation produces in the accounts. Like replacement cost instead of original cost, which tends to exaggerate profits, the treatment of inventories, which also tends to exaggerate profits, and so on. And one of the major ones is precisely the fact that the debt, the interest that you should apply to the debt is not the normal interest rate but the real interest rate. That is, nominal minus inflation.

Now-- yes?

AUDIENCE: [INAUDIBLE]

MODIGLIANI: I'm sorry?

AUDIENCE: It seems to me that that's not the correct way of computing the ratio. [INAUDIBLE]

MODIGLIANI: Yeah. I mean, in other words, they don't understand that you have to adjust the deficit for the inflation, for what you gain from inflation.

AUDIENCE: Yeah.

MODIGLIANI: All right.

AUDIENCE: Okay, but why do they do such a mistake? I mean--

MODIGLIANI: Why do they make such a mistake?

[INTERPOSING VOICES]

MODIGLIANI: All right, now, I think there's a combination of reasons. Okay? One reason-- let me go back here. One reason is simple ignorance. Okay? People do not understand the simple reasoning. And the ignorance is not just limited to the chancellor of Germany. It's widespread, even among the Italian public.

You are familiar with the fact that people in Italy have complained bitterly when, during the Ciampi government, things were going well, inflation-- and I show you a graph-- came down miraculously in a very short time. Interest rates came down, and people were complaining like mad! I used to get 12%! Now all I can get is 5% or 7%!

The fact that there was no inflation didn't matter. And, fundamentally, it is because of a very deep misconception because people don't understand this phenomenon.

Now, let me just cite you here one thing that's fascinating. Generally, there is a great contrast between economists and the public, common man. Economists always say inflation makes no difference. Because everything moves together, and so it makes no difference.

Well, first of all, they exaggerate. In fact, it does make a substantial difference, but it's a secondary order of difference, is that prices get out of line, that certain things lag behind, that [INAUDIBLE]-- everything cannot move together, because you cannot change the coin that you put into the parking machine. Okay? So the parking machine is now for $0.05, and even though the prices have doubled or trebled you still are not going to change it. Okay?

So it is not true. Now this is a different example, but there are many more examples, like taxes and so on, that are not adjusted appropriately. Similarly, you are taxed on nominal interest rates. No country yet taxes on real interest rates, which is the only reasonable thing. Okay. So that you end up by taxing over 100%.

If you do things correctly, you will find that the tax is more than the real interest you earn. In real terms, you end up with less money than you started out, even though you get some interest. Okay? You can see that, if you get 10% interest but inflation is 15%, then, at the end, you've got $95 per $100 that you had. But you get taxed as though you were earning 15%.

So, in general, people don't understand it. A very great example of not understanding is a recent survey that was made by one of my students, one of my-- by now, of course, more important than I, professor at Yale, and [LAUGH] belongs to the large class of students of mine who have done better than I have. However, he conducted a survey-- in various countries, including the United States, and including Brazil-- asking people whether they thought that wages kept up with inflation.

And the remarkable result is that people said, of course not! And he asked them, how long you think it takes before they catch up? And a very few said, oh, a quarter. Mostly say a year or two. Some said never.

Even in Brazil, where wages have-- you know, the inflation was so high, the wages were keeping up [LAUGH] instantaneously, practically. Okay? They better do that, because when inflation is 300% per year or more, if they don't keep up you're left nothing.

So people don't understand that, in fact, wages-- the experience is very clear. Wages follow inflation very closely. Inflation doesn't really affect real wages, except occasionally in some [? transient ?] period, and so on. But, by and large, real wages are not affected by inflation.

But, you see, the reason why people think it's so terrible is the following. I mean, I think there is evidence of this. They think that when prices go up, and they get higher wages, they think they get higher wages because they are worth more. So their increase in salary is the recognition-- is the real increase-- is a recognition that they're worth more. But then those [? damned ?] merchants take advantage of the fact that I deserve more, and they raise prices, and they take away what I have earned.

So inflation is all due to these bastards who take advantage to raise prices. And therefore it's not true that my wages keep up with prices. My wages keep up with my worth, and prices just take away what I deserve.

Now, when you start from this mentality-- and Mr. Kohl is probably not very different from these people. I don't even know him personally, so I don't know. But it's very easy not to understand.

And, on top of that, the Bundesbank, which you think is intelligent enough to understand, has a different reasoning. It says that, if inflation makes you a pariah because of the deficit, good. Inflation is a bad thing, and anything that makes it bad is a good thing. Okay? So, if by not understanding how to compute, it makes look like you have a large deficit, the answer is, stop inflation! Don't calculate the deficit correctly; stop inflation.

Now, that's very important, because the miracle we are proposing is precisely that, since you don't understand how to compute the deficit with inflation, we are going to get zero inflation, and then you will see that the deficit disappears, because the interest rates from 9 and 1/2% will come down to 4% or 4 and 1/2%, and the deficit will disappear. Then the next trick is, how do you get zero inflation? Okay?

And that's, of course, the real important trick. And that requires for workers and the unions that represent them to understand inflation illusion-- on their part. That is, to understand that what matters is real wages, not nominal wages. If you're given a certain real wage, if we can agree on the real-wage path, then you shouldn't care how much you get nominally. And, in particular, you can accept zero, as long as the prices were to fall 4% per year, and your real wage would rise.

Now, we don't need to do that. We could just say, let's aim at zero price inflation and 4%-- or 3% or 4%-- increase in wages due to productivity. So the trick is to workers to accept the notion that, from now on, they will have an increase determined by productivity. Okay?

Accept, therefore, a wage increase which is no longer. When wage increases correspond to productivity, unit labor cost doesn't change. When unit labor cost doesn't change, prices do not change. Okay? Provided the exchange rate is maintained or is declining.

And in the case of Italy, in our program, therefore, consists of holding inflation, aiming at zero inflation, through agreement with the unions and the employers and the government. See, the government must do its part by not raising indirect taxes, and so on and so forth. There's a number of conditions that must be met.

Have a compact that aims at zero inflation. Then, you get, as benefits, first of all, the vanishing of the deficit, and you meet the Maastricht condition by having very low inflation and very low, zero, deficit. Okay? Now, you do not meet the deficit, the debt-to-income ratio, but that-- it's a stupid condition, and it's been always said that nobody's going to look carefully at debt condition, as, provided you can show that you are making progress, it's immaterial.

And, of course, with a balanced budget you would be making progress toward that aim, because, as the GNP rises, the ratio declines. So you don't even need the surplus. Just the growth, per se, reduces the debt.

And you can do quite a bit, that way. Let me note that the United States came out of the war, of the Second World War, with a debt that was 1.4 times income. By the time Reagan became president, the ratio was down to 0.38. Okay?

Then, of course, Reagan quickly reversed things and [INAUDIBLE] didn't quite manage to go back to where we were. If he had stayed as president long enough, he would have done it. But fortunately you cannot be president more than twice, in this country, so we got rid of him. [LAUGH]

And, after that, it's still been very hard to bring down the deficit, because t he interest got so large that people weren't willing to pay their taxes, to pay the interest, the Reagan interest. And that made it very difficult to avoid some deficit. Okay? But fundame-- yes.

AUDIENCE: I have a question.

MODIGLIANI: Here's the representative of the Italian Labor.

AUDIENCE: [LAUGH] My question is [INAUDIBLE] you are assuming that you can control [INAUDIBLE] inflation by holding [INAUDIBLE]

But I remember those data that we received from the [INAUDIBLE], and they showed that approximately between July of 1992 until--

MODIGLIANI: Between July what?

AUDIENCE: 1992, after the--

MODIGLIANI: 1932, yes?

[INTERPOSING VOICES]

AUDIENCE: Until the middle of 1995, the [INAUDIBLE], the unit labor cost [INAUDIBLE] remained still, still, and inflation had risen up approximately 5% [INAUDIBLE]. So it had a fixed unit labor cost. Still, you had inflation.

Now, what were the determinants to that inflation? Certainly there was exchange-rate effect. There was also profit effect [INAUDIBLE]--

MODIGLIANI: But you cannot separate the two.

AUDIENCE: And there was also another dimension, I think, the inefficiency of the Italian [INAUDIBLE].

MODIGLIANI: That's right.

AUDIENCE: I think that--

[INTERPOSING VOICES]

MODIGLIANI: That is true. That is true. I mean, that is part of the program.

AUDIENCE: [INAUDIBLE] your program say [INAUDIBLE] inflation only [INAUDIBLE].

MODIGLIANI: I think you have to answer, separate, two different issues. One issue is that, in effect, the price is determined by the labor cost, provided the exchange rate is maintained. Okay? If the change rate depreciates, then the maintenance of the unit labor cost does not imply that workers maintain their purchasing power, or that their purchasing power increases according to productivity. All right?

Because, if CLUB-- "CLUB" is what the Italian mean by unit labor cost-- in Italian is [SPEAKING ITALIAN]. So it's CLUB. Okay? CLUB. And that terminology was actually invented at the Bank of Italy when I was in charge of a model, modelling Italy. We invented the word "CLUB."

CLUB concept means that wages rise as much as productivity, which is the program. Okay? Now, that ensures that real wages are constant, in a closed system. Because you can see that, in a closed system, CLUB is the reciprocal of the real wage.

Now, essentially, if you are in an open economy, then the purchasing power of wages has two components-- purchasing power over your own output, the domestic output, and purchasing power over the foreign output. Okay? Now, if the exchange depreciates, then, even though the purchasing power over your own output is constant, the purchasing power over foreign output is not constant. So depreciation per se makes you lose-- makes the worker lose-- purchasing power.

But that's not the end. When you have depreciation, the domestic firms find that they can sell abroad at a higher price, because their price has fallen. With the depreciation, the price in dollars falls. So, to some extent, they try to sell more. And, to some extent, the raise the markup.

But when they get more abroad, particularly if there is high activity, they also get a higher price at home, in part because they have the choice where to sell, and in part because foreigners are unable to compete, because they get less dollars per what they export. Okay? So they have to raise their prices, and that makes it easy for the domestic people to raise their prices. In other words, the devaluation makes them increases the ability of the domestic firm to sell abroad or at home. And, to some extent, that shows up into higher markup-- and higher profits. So, in that sense, you cannot divide the two.

But that is precisely the sense in which it is essential, in a program of this kind, to look at the effect on the foreign exchange. And one of the things we have in our program is that the foreign exchange, the lira will appreciate, so that the workers will gain, in fact, more than the productivity through the depreciation. And that's only fair, because they lost, before, through the depreciation, at the advantage of firms.

Now, over the next period, you're going to have a reversal. Firms will be somewhat squeezed, and workers should be earning more. Okay?

Now, this is happening at the great rate because, fortunately, the victory the center left has been greeted by the international markets with great warmth-- enthusiasm. And the lira has moved, since Prodi won the elections, down to just over 1,000. It was about [? 1,600. ?] It's moved down to 1015. A remarkable thing. Our plan is being outdated, because our program was to bring it to 1,000 in two years. We'll get there before, but that's fine.

Now, probably we don't want to go much beyond that. Why? Because we think that 1,000 is a very nice exchange rate. Because, once this happens, we'll issue a new lira-- we'll call that "heavy lira"-- which would be worth 1,000 old liras, and one mark. Okay, so a lira would be one mark. Now--

AUDIENCE: I have a question regarding [INAUDIBLE] is that a [INAUDIBLE] option for Italy to go to a [INAUDIBLE]

MODIGLIANI: Yeah, well, this is-- the currency board has been mentioned. And the trouble is that that solution, in my view, is a mechanical, ignorant solution. That is, it's true that if a country doesn't have a reasonable labor union, then maybe what you want to do is to say, look, I put myself in a position where I cannot control the money supply. If you push wages, you get unemployment. And you do that, you tie your hands.

I say, if you have an intelligent labor union, let's agree on how to do it and let the money supply be adjusted to the needs of the economy. Okay? So, if the economy is growing fast, we'll get more money! Why do we have to wait until we import-- we get more reserves, and then grow? We don't have to do that.

So the currency-- I mean, this so-called currency board-- as you know, this has been adopted-- this is essentially a Hong Kong system. Okay? Well, essentially, Hong Kong creates money only as it gets dollars from the surplus. Okay? So, as people deposit dollars, they get Hong Kong dollars, one for one.

And there's all kinds of problems with it. I mean, in fact, right now Hong Kong has a lot of problem, because the inflation, domestic inflation, is appreciably higher than the foreign inflation. So you have all kinds of problems-- high interest rates and all kinds of real problems.

And I think, counting on intelligent unions, I think we can do it. And, by the way, I can say one thing that's very important, that the head of the union which [INAUDIBLE] has already declared twice that he is for the zero-inflation program. That they will work for it, and that he looks forward--

In fact, he asked the new president to call them in for consultation-- which he hasn't done yet. He said, what are you waiting for? We are here, ready to work together.

Which doesn't mean that it will be so easy to reach an agreement, because there is a question of the past. Workers have lost some-- not as much as they think. First of all, because the comparison test would be made-- see, the comparison the workers make, when they say, we have [INAUDIBLE] so much, is between agreed wages and the cost of living. But actually there are-- effective wages are not necessarily as those in the agreement, because there are payments above the agreement.

Now, if you look at the actual wages, the differential is not so large. But it is still there. Probably 3% in two years-- something like that.

But the point is that the argument we are trying to make is, don't try to recoup the 3% now, because you won't. If you get a high of 3%, it will show up in higher prices. Okay? Have an agreement that looks forward and says, from now on I get the cost-of-living unit plus the benefit of the declining exchange rate. Then everybody will be better off.

Now, one, of course, of the important consequences of the zero inflation is that interest rates will decline roughly by the extent of inflation. Now we have 4 and 1/2, and interest rates are already down to about 9. See, when I first wrote this, inflation was 5 and interest rates were about 9 and 1/2. They can come down another four or five points. Okay?

That also means that it encourages investment. Of course, there is inflation illusion, that is, [LAUGH] firms should really figure that the real cost of money is the same if they pay four and no inflation [INAUDIBLE] if they pay nine with inflation. But it actually makes it difficult, in part because, in terms of short-term rates it makes no difference, but in terms of long-term rates it does make a difference, because if you don't think inflation is going to last, then borrowing at 9% is a bad thing. Because eventually you will have paid 9% when interest rates will have come down.

So it does make a difference what the normal rate is. So you will have that advantage. And, of course, essentially, by controlling cost, you will be able to maintain the advantage in terms of exports. There will be some loss, because, as the lira appreciates, that will make it somewhat worse. But then, to some extent, the appreciation will correspond to the fact that Italian inflation is below French or German or Dutch or whatever it is, and that, per se, justifies appreciation.

So those are the fundamental tricks. What is being proposed in Italy-- see, I didn't quite finish that. There is the 7%. People who speak have refused to understand that that deficit doesn't exist. We had an argument with Italy's most known financial specialist, who is now representing Italy in the government of the community, Professor Mario Monti, who claimed that no, he does not want to make the adjustment. Okay?

We explained why it has to be made, and he said no. And I think I told you that the reason he said no is because he thought that if you tell the Italians they have no deficit, they will create one immediately. Okay?

[LAUGHTER]

So you must tell them, you are overburdened with deficit. Therefore, you have to cut down the expenditure. Otherwise, it's impossible.

So an economist must lie, in order to sort of tell falsehood people, so they behave as he thinks they should behave. I don't believe in that. I Because economists should say the truth and tell them that, because you have no deficit, bless God and don't get into one. Okay? That's the thing to do. You don't have to be persuaded by being squashed by the deficit.

So what-- just a second. Let me just finish this. So what are they saying? Well, I said, some say, let's not give up Maastricht. And some say that, next year, we have to do a really big financial operation, so as to cut down the 7% to 3%. That means a tax levy, tax and expenditure levy, of 4% of GNP. Which is a gigantic-- it's 170 billion. It's a gigantic operation.

For what? In order to create a surplus, in order to balance the budget, with the fictitious deficit, but really create a huge surplus. Increase further the primary surplus, create what is really a huge surplus, and, as I'll show you in a moment, create a real deflation in the economy and, in the end, a disaster.

So what we say is, forget the big financial levy. Forget the-- how do they call it? I forget the word they use. The-- [INAUDIBLE]. I forget the word that's used. [INAUDIBLE].

Anyway, forget the-- the big-- the big maneuver Okay?

[INTERPOSING VOICES]

MODIGLIANI: Huh?

AUDIENCE: Stangata.

MODIGLIANI: Stangata, which means "beaten." Forget the big beating with a rod. Okay? Forget it! If you do that, you ruin the economy-- and you don't need to! Okay? If you can get zero inflation, or just about there, you don't need it.

Now, before I go further and show you essentially the implication of the alternatives, I have to be one comment. Why-- see, we say "zero inflation program." And we want a program wages are still maintained unit labor costs stable. Why can't you get zero inflation, in '97? In-- yes. Why not immediately? Why not in '97?

The reason, unfortunately, is that there is lags in retail price formation. All right? Essentially, at the retail level, prices depend on what it costs now to buy that good but, to a large extent, on what you paid for it last year. Okay? Or essentially the inventories are treated at cost, not at a production cost.

So they try to recoup that, by prices not adjusting promptly. And so that means that, if you're trying to come down very fast, you end up by creating a larger spread for the intermediaries, for the retailers, and so on. Which they may not notice, because they don't figure things right. Okay? Their products really are higher, but they may not even notice it.

So, you cannot do it too fast. Because, if you do it too fast, you end up by increasing their profits at the expense of the workers. Okay. See, the manufacturers at the wholesale level will have no advantage, because they presumably will pass on the unit labor cost into their prices. But it is at the next stage, at the various stages of services, plus the fact there is a large volume of services which are not based on goods but sort of various kinds of professional service, and so on and so forth, where the lags tend to be more substantial.

In other words, in the case of labor you can make an agreement about the wage. You cannot do that as easily with the cleaners, with the lawyers, with the doctors, and so on. Yeah, well, you can do it, to some extent, with government employees, although that has some problems of its own.

So we have to accept a slower pace. And that means that real wages initially can not rise very much. They can rise some, but there's a limited space until the catch-up is finished. That is, until we get to the point where, while you're bringing them down, there is some unavoidable loss. Once they are down, the loss will disappear.

One way of minimizing that loss would be to get, as he says, a more efficient service industry. Okay? Now, that's one of the great difficulties. And I think any of you that come from the less-advanced countries know the great problem, that the whole area of retail is exceedingly inefficient. You're still relying on the family store, which has huge markups, because they're very inefficient.

There are the efficient stores, the supermarkets, the markets and the supermarkets. But, as you can imagine, the merchants hate the supermarkets. They really are ruining the country, because they're ruining me, and I am the country.

So they fight very hard against giving permits and very hard for all kinds of ridiculous things which we still have, even in this country, namely, hours opening and closing hours. Stores can only open at 9:00, and they must close at 6:00. Okay? Hell, why? Why don't you let anybody does whatever he wants? It's because it's not convenient for those people that exist.

So you have this tremendous stronghold of this class, intermediary class, which is large and controls a lot of the local communities, in an effort to get a more efficient distribution. But that, I think, is quite right. A lot of the program should be in pushing through a rapid nationalization of the distribution system, creating competition if necessary, even stores, government stores or local entity stores-- I mean, not central government, but local stores that compete, and so on.

AUDIENCE: I worked in Germany for a year, experiencing problems with stores closing very early. Do you think that--

MODIGLIANI: Where?

AUDIENCE: In Germany. I worked in Germany--

[INTERPOSING VOICES]

AUDIENCE: --very bad problem there if you're working--

MODIGLIANI: Yes, that's right.

AUDIENCE: Do you think that people have any power to force [INAUDIBLE] to change those laws? Or how strong is this [INAUDIBLE]--

MODIGLIANI: I think that that is a great problem, because this class of merchants is very powerful, has enormous influence. Where do you live? In Rome?

AUDIENCE: Rome.

MODIGLIANI: Yeah. And that's nothing. I mean, if you go to the south, some of the smaller places, they're just very, very hard.

AUDIENCE: [INAUDIBLE] popular opinion?

MODIGLIANI: That's right. That's right. I mean, you've got to be careful, again. Distinguish between-- I mean, more powerful, which simply means it's a combination of will and the organization that it takes to make that will into an action. Okay? There may be a lot of people who are unhappy, but they never organize. They don't put up candidates, and things like that, whereas the merchants do.

And, you know, the merchants in Italy are a bad class. There is no question about it. [LAUGH] We have seen that, recently, when they gave a real example of indecence when they invited to speak at their convention the fascist, the head of the fascist government, and Mr. Prodi, who is now the president.

And Mr. Fini was applauded. And when it came to Mr. Prodi, they did not let him speak. They hissed and shouted, so that he had to quit without speaking. They were the merchants had been invited to shout against Mr. Prodi, essentially because the center left is in favor of laws that will make people pay their taxes. And the merchants don't intend to do that. They want to do whatever is convenient to them.

So, you have this problem of-- for which it is not possible to do things quickly. And you have a trade-off between real wages and quickness. [INAUDIBLE] real quick, then the real wages will not rise. If you take a little more time, then there is a possibility, some margin, for real wages to rise.

Now, I want to come back a moment to the following thing, that the-- so the key propositions really are-- I think I've told you essentially what is the foundation. And what makes you think that all this is feasible? All right. And, as you can see, if you follow this program, then, in two years Italy will meet all the requirements for being Maastricht. At least in three years, because the deficit will come down, gradually, as interest rates decline. So it's not instantaneous. Interest rates will move down with inflation, and, as inflation comes down, interest come down, and the deficit comes down.

And then, of course, you do have this important mechanism-- which already occurred, unfortunately. I should have known that. Namely, that, as this goes on, the exchange rate appreciates.

Of course, I know that there are expectations. And, since people expect that this will happen, in fact it happens quickly. And, in fact, to some extent, interest rates will decline on the expectation [INAUDIBLE], particularly the long rate. And the long rate is still quite high. And anybody can figure out that are huge capital gains to be made, if you buy issues which were still made three, four months ago with a 12% coupon, if the interest rate comes down to-- long-term rate comes down to 5, these are 10-year issues, the price will appreciate enormously.

Now, it may appreciate enormously in the expectation that it will be high later, and therefore some of these things may occur faster than you would think, if you didn't allow for people believing that these things will happen. This will all happen to make it happen, or will help to make it happen.

Now, there is, I think, important precedence to justify this expectation. Of course, one of the key issues here is the issue of interest-rate behavior and relation between price, between wage and prices. Okay? Now, on this connection, we have first done some interesting experiments.

First, let me say this. That, during-- see, one of the great wonders of the period that follows the devaluation was the behavior of inflation.

Now, let me see if I can find this. Yes. You have all seen-- oh, let's see. I think that Elizabeth made a slide of the-- [LAUGH] that is the cover sheet of the book. But that's not what I'm looking for. Okay.

Now, one of the great wonders of the inflation of the period in which the lira was depreciated was the following. When the lira was pushed out of the EMS, it lost initially about 20%. And then, over the rest of the year, [INAUDIBLE] under Rudi's-- Rudi Dornbusch-- influence--

Rudi Dornbusch, by the way, is a miserable man, because--

[LAUGHTER]

--they had [? sorrows, ?] and they didn't tell me. He didn't tell me, so he's a miserable man. But--

[LAUGHTER]

--nonetheless, he is a miserable genius. And, as I explained to him, he pushed the Bank of Italy to let the exchange go, not try to get back into the EMS, keep interest rates low, let the exchange depreciate. And it depreciated up to about 30%-- it reached a peak about 30%-- from below 700 to 1,000.

Now, of course, at that point it makes a difference whether you calculate the lira-- and when you look at the changes of that magnitude, you get some different answers if you look at the lira-mark, or the mark-lira, but anyway that's roughly 30%. And the great, amazing thing is that the behavior of inflation. When that happened, inflation-- the graph with inflation-- is 3.8. Can you see that? 3.8, at the bottom. Right?

[INTERPOSING VOICES]

MODIGLIANI: All right. Now, you have there one dark, heavy, dark line. Okay? That line is what actually happened. And, as you can see, inflation, up to 94, inflation kept the climbing in the face of a 30% devaluation. It was an absolutely amazing experience. Okay?

It eventually picked up again, but that is because Ciampi was replaced by Berlusconi. And, since he was an incapable man, he quickly produced inflation again. Okay? I mean, as a head of the government, and then as the opposition-- who was blackmailing the country. That's how he managed to get that.

But you can see that, up to as long as Ciampi was there, the inflation declined. And if we had quarterly data-- well, actually, you can see it very clearly.

Now, one interesting question that we have asked ourselves is, why has that happened? How is it possible? How could one achieve this result? Okay?

Now, the standard explanations are-- and sort of important information-- is that, to some extent, the devaluation of '92 and the '93 was a very weak era in the world markets. Therefore, on the one hand, raw-material imports, because raw-material prices were falling in the world, they didn't rise too much in liras. Relative to what they were doing abroad they rose more, but not much more.

And the noncompetitive market-- that is, the industrial production, and so on-- [INAUDIBLE] kind of goods, the foreign firms were pressed for markets, because they were losing markets all over, decided that, rather than take advantage, rather than sort of, well, keeping their prices constant, which would have meant higher prices in lira, they will try to compete with the Italian firms by cutting their price. So they essentially cut their export prices in marks. Which meant that the Italian prices rose less, and then, in turn, put pressure on the Italian firms not to raise prices too much.

This combination of things was certainly one important element. Now, in addition to that, there was domestic contraction, in '92 and '93. Okay? I explained that, essentially, that domestic contraction was the combination-- in '93, it was the combination of the shock of devaluation-- the Italians are a pride, I would say, pretty proud people, sometimes not reasonably so. [LAUGH] Just like the Spaniards or whatever it is. [LAUGH] or the Greek.

And they took very badly the devaluation. It caught them in something demeaning that they had to devalue 30%. Okay? And it took time to understand that that's what made their fortune, but that was the meaning. That was a source of depression.

And on top of that, the Amato and Ciampi government, the good governments, beat them in terms of taxes, really hard. They raised taxes, and they made a big step which moved, essentially, the real deficit to zero. The corrected the deficit, came close to zero already. Then, [? lira only ?] got even more so-- but already very close to zero, through this very sharp rise in taxes.

That reduced consumption and discouraged people and put them in a very depressed mood. And so you had then lower consumption and lower investment, because the activity was low, so they were-- the only thing that was pushing was exports. Because the revaluation put them in a position to increase exports, and they rose quite fast.

But, on the whole, there was a contraction, and that presumably may have helped in holding prices down. But, of course, there was another element. And that was that, in 1932, for the first time, labor agreed to a nominal-wage contract that in 1993 was confirmed by Mr. Ciampi. And there was a specific arrangement about a plan for prices and wage inflation. Both of which were supposed to decline over the next three years. 4 and 1/2, in '95, 3 and 1/2 in '96, and 2 and 1/2 in '97, was the program.

I personally told Mr. Ciampi that that program was inadequate. It should have been 2, 1, 0. Okay? Well, before I got there, it was even higher, and he did cut it down. With some effort, he was able to persuade them to cut some, but still it was better than nothing. Okay? And the wages were supposed to behave accordingly. Allow room for productivity, to some extent.

Now, the interesting question is, which of these-- oh! And then, on top of that, there was the Amato-- I mean, there were these fiscal laws which, by reducing income, contributed to a depressed economy and therefore contributed to lower prices. So the question is, what did what?

So, to try to answer this question, we have made three simulations, the results of which are shown here. The first is the following. A group of people-- and particularly, I think, at the Bank of Italy-- said that the reason why inflation was still 4 and 1/2 or 3 and 1/2 is because we had devalued. In other words, with the devaluation we had no inflation. Without devaluation would have been even lower. Okay?

Why? Because, without that, there would not have been higher import prices. Right? The devaluation increased import prices-- and domestic prices, too, to some extent. So they said, if you just had forgotten, you just had-- and they don't say how-- if you just had somehow managed to weather the storm and not devalue, or maybe 15%, as they first thought, but no more, you would have saved yourself all the trouble.

Now, it turns out that-- so one of these simulations, see, the first one, the heavy line says "Storia." That means "history." That's the actual history.

Underneath that, here, "lira [ITALIAN]." That is, keeping the lira in [INAUDIBLE], possibly 15% lower, but fixed exchange. Okay? So you've got in the new rate.

Of course, they don't tell us how you do it, because the Bank of Italy tried that and was unsuccessful. That is, the investors didn't believe it. Therefore, they kept pulling out money. And the Bank of Italy threw in a lot of reserves, and then, at the end, gave up.

And, in fact, the one crime that has been claimed by Mr. Berlusconi, when he attacked Mr. Ciampi, who had been prime minister before him, is that he's wasted billions in trying to defend the lira when he shouldn't. And maybe he's right, to some extent.

Mr. Ciampi was perhaps conventional, and central bankers hate to yield to speculation. They always hope to beat the speculators and give them big losses. And so he tried, hard. Anyway, it didn't succeed.

So this simulation tells you what would have happened if you somehow had managed to put together enough reserves to throw into the breach, so as to maintain the 15%. And then, after that, you had to keep very high interest rates, to attract capital. Okay? So you really would have had to continue with the 15%-or-so interest rates that prevailed as the Bank of Italy tried to bring back the [INAUDIBLE] 15%, 20%. They just reached 20%.

Now, in that situation, of course it is true that you get the result which is shown by the broken line. Okay? It is true that inflation would have been lower. If you somehow could have maintained the exchange rate, you would have averted devaluation. Inflation would have been lower.

However, at what cost? Well, the cost you can see in the remaining graphs. First, in terms of the GNP, you do get a depressed level of the GNP. Even though, in '94, for a complicated reason, it's a little higher, but the rest, it's lower. Except in '94, it is always appreciably lower and accumulates to something like 4% more.

So you would have to sacrifice output-- and employment. Italy had plenty of unemployment. That policy would have led to more unemployment.

This shows what it does to investment. You have high interest rates, therefore lower investments. And so on. And, of course, the worst part is in terms of the balance of payments.

You would not have had the huge increase in exports. Therefore, the balance would have remained negative, and you would have been accumulating more debt. Which, presumably, at some point would have forced to devalue, anyway. So at best it would have been a transitory policy and would have been pretty bad for a country.

Then the next thing we tried was to see, suppose you had everything else equal. You are out of this [INAUDIBLE]. But let's take out the amount of tax measure. Okay?

Now essentially-- without going into details-- what that does is actually to somewhat reduce employment, because the drain from the economy would have reduced the demand. So, in terms of output, you find that the Amato maneuver would have-- in other words that, without the Amato maneuver, the output is higher. And the--

AUDIENCE: [INAUDIBLE]

MODIGLIANI: Right. The Amato maneuver is the thin line. And, uh-- We have to be a little careful, here. No, no. No, I guess that, uh--

The reason is, I think, essentially that you might have spared yourself the great deflation of '93. I don't remember exactly how that works. But, in terms of inflation, the Amato maneuver doesn't really make too much difference.

Now, the last-- that is the broken line. Okay? Now, in terms of inflation, you get a lower rate of inflation, because the Amato maneuver is a deflationary maneuver. So you get less inflation. But you get bad consequences, in terms of output.

And then the last one is essentially the effect of the labor. And it shows what would have happened without the labor agreement. And the results are dramatic.

The top line is the rate of inflation that would have existed without the accord. And you can see that while inflation declined, it would have increased substantially, gotten to a high level, lot of harm to the government deficit, and so on and so forth. And we conclude essentially that the fundamental thing that worked is the agreement, the labor agreement. That was the fundamental anchor that permitted the low rate of inflation.

So that means that we know that, if we can get labor and the rest to work together, and we can maintain the exchange rate stable, then we really have a good handle on inflation. So that's important to understand what works and what doesn't.

Now, when you look at, of course, the whole history, you've got to remember this particular episode that, in the spring of '93, I mean, Ciampi came in in the spring of '93, and he contributed to the lowering of inflation. As long as he was there. He then left, and the dramatic effect of Mr.-- well, the contrast between Ciampi and the next government is in a graph which I hope I can find here, which shows two things-- the behavior of inflation, the behavior of exchange rates, and the behavior of interest rates.

The dramatic thing is that, under Ciampi, the differential between the Italian lira and the German mark, which measures the trust of investors in lira-denominated instruments. Okay? How much they believed the government would pay, and to what extent they believed the exchange rate will not deteriorate. It's a major measure of that. Under Ciampi-- I cannot find it immediately-- the premium went from about 5 and 1/2 to 2 and 1/2 in a little over a year.

Now, Italian interest rates are determined by what? Fundamentally, you live in a country now which has totally open capital movements. So, when I speak of investors trusting the government or not, I speak primarily of Italian investors. It's not Mr. Soros, it's the Italians that either trust the government and keep the money there or don't and just pull out that money. Okay?

And when, of course, people want to move their capital out, what happens? As you understand, if you don't have fixed exchanges-- if you have fixed exchange rates and capital moves out, then the central bank pays out reserves and the dollars-- you know, you want dollars? Here is the dollars. Take them out.

As long as I have reserves. At some point, I have no more, and then I have to revalue. Which happened in 1952.

But when you don't have that, when capital wants to move, there's only one way capital, as against reserves, really moves, and that is by moving goods. So, in the long run, the only way you can move capital is by increasing the net exports. What happens in the short run? Well, I want to sell liras, and nobody wants to buy them. I will buy marks, and nobody wants to sell them, well, the lira goes down. Okay? You get sharp depreciation effects.

Now, under Mr. Ciampi, the exchange rate improved somewhat, not dramatically but improved somewhat, nor was it desirable for it to move too much, because the export surplus was essential to the maintenance of the Italian development. But the decline in the risk premium showed up in a decline in interest rates, because Italian interest rates in an open market are German interest rates. Okay?

Now, let me step one back. You remember the fundamental principle of interest rate parity. Right? That interest-rate differentials is essentially compensated by depreciation. That is, if a country has a higher interest than another, it is because each country is going to depreciate.

Because the real return to a German investing in lira is the lira return minus the rate of depreciation of the lira. Okay? So, fundamentally, you have the interest differentials equal exchange-rate differential. But what about the exchange-rate differential?

You know about purchasing-power parity. Under purchasing-power parity, exchange rate differential is the differential in the rate of inflation. So, fundamentally, Italian interest rates, real Italian rates are equal to real German rates, plus this premium, or nominal rates are equal to German nominal rates minus German inflation plus Italian inflation.

Now, as the inflation was coming down, but mostly [INAUDIBLE] premium came down enormously, interest rates went-- came down about 5 percentage points, in little over a year. Okay? The government deficit improved, and the investment were helped, and so on and so forth. So that was a dramatic effect of Mr. Ciampi.

The moment he left, everything began moving in reverse. The exchange rate began to depreciate again, modestly. Interest rates went up rather quickly back. And, by the end of the Berlusconi government, they were close to where Mr. Ciampi had left.

And whatever he didn't do, and why did that happen? Well, because the rest of the world had no confidence. See, Ciampi was an exceptional man. He was the former governor of Bank of Italy, with an international fame. He was very well known. He had worked for many international organizations. He was trusted.

Mr. Berlusconi, there was no reason to trust him. He had to show. Well, he began by not paying any attention to the finances. He did not prepare the first financial plan in time. He let two months go by, because he was busy with capturing the televisions. He owned, he had the monopoly on the private sector, and now he had the government televisions under his wing. So he took care of changing all the people so they'd be his people, and so on. Was so busy doing that, he paid no attention to what was important.

So, even though, as he came to power, I wrote an article, [LAUGH] in the Corriere della Sera, Mr. Berlusconi, the main thing you need to worry about is give confidence to foreign investors. Continue the tight fiscal policies. He came in promising tax cuts and the like.

And he proceeded to do it. Much of that was wrong, because even though, in some cases, it was justified as incentives, they were stupid incentives for Italy. Essentially, you got an incentive if you hired more people.

But you know Italians are. They took the firm, divided it in half, and, from the old firm, they set out a certain number, and then they were taken by the new firm.

And the new firms, of course, was creating employment. Therefore, they got the benefits. And the same thing happened with incentive to invest, where all kinds of dirty tricks occurred. So there was a lot of money wasted in these programs.

Anyway, the limit was reached, of course, as I told you, when Berlusconi was pushed out of the government. He wanted immediate elections. He said, I want elections in spring.

And the president of the republic told him, go to parliament, because I don't control the elections; parliament does. Tell them to dissolve themselves. Then we'll have elections.

Since he could not persuade parliament, he decided to boycott the country, to put pressure on parliament by ruining the country. So he decided to vote against the financial law that was proposed by the government that succeeded him-- a law which was absolutely essential, because his own financial law had been inadequate. Okay?

When the world saw that half the country was willing to ruin the country to have its way, well, everybody took the money out-- including I. I had very little. But whatever I had--

[LAUGHTER]

--I took out. [LAUGH] I had just a deposit with a bank. Anyway, the lira jumped from about 1,000, when Berlusconi came in, to 1,280. Okay?

Now, at that point, of course, the tragedy was that the inflation, the devaluation of the lira, created inflation, through the two routes I mentioned-- namely, foreign goods were more expensive, and Italian firms were able to charge higher prices. The markup rose. The wages kept on their path. That's agreed. Remarkably so. But prices did not.

By the way, the plan was 4 and 1/2, 3 and 1/2, 2 and 1/2. As long as Ciampi was there, it was 4 and 1/2, and it was 3 and 1/2, to the middle, to the time he left, inflation was down to 3 and 1/2. I think you might be able to see it from the graph. But anyway, it was down to exactly 3 and 1/2.

As soon as Berlusconi took over, with the devaluation, the inflation went up again. So the reason the whole thing failed is not that the idea of a pact was wrong. It's not that you cannot not have a pact. It's only that, for the pact to work and to be fair, you must avoid devaluations. You must avoid devaluations, which [INAUDIBLE] Italy had had many devaluations. But in the past, they were essentially due to labor pushing for higher manual wages, which eventually made the Italian product noncompetitive, led to financial crisis and to devaluation.

But this time the devaluation had nothing to do with wages. Wages were perfectly well-behaved, unit labor cost was well-behaved, and the devaluation only had with capital invested in Italy, by Italians and foreigners, losing confidence in the country and trying to get the money out.

So, that created a period of great uneasiness, because the workers were losing and getting more and more questionable as to whether you ever wanted to enter in another agreement like that. Okay? And, of course, stupid people-- like the one I debated on TV-- claimed that, if we had had escalator clauses, that wouldn't happen. And that's because he's an idiot. He doesn't understand that--

And I tried to explain it to him. And you know what he did? He laughed, while I was explaining. I was trying to explain to-- I didn't see him, but I'm told that's what he did.

I tried to explain to him that, if we had had escalator clauses, we would have had inflation and the same loss of purchasing power. Only [INAUDIBLE] inflation [INAUDIBLE]. Because the inflation is unavoidable when you devalue. Right? When you devalue, foreign goods cost more! Okay?

And if you try to index, your productivity having not changed, you've tried to keep up with foreign prices, costs go up, prices go up, and so you get inflation, and then wages have to go up, to catch up. So there's nothing you can do. The workers do lose whenever there is a devaluation-- of that magnitude.

So, since then, the exchange rate has moved back. And, thanks God, there'd been a tremendous last step when Mr. Prodi won the elections. Now, we are essentially working with that principle of getting down, back [INAUDIBLE] to get the workers to believe that we will not have any more devaluations. Okay?

Now, it's not, unfortunately, entirely simple, because you have people like this Mr. Bertinotti, who is the head of a group that commands 9% of the vote, which is extreme left. He really is a communist. And he's as stupid and ignorant as the communists are, in economics affairs. You know, communists may have certain virtues, in some areas, but they never understood economics very much. As you can see from Russia.

And he keeps insisting that we should have escalator clauses. I, and the head of the unions, say we do not want escalator clauses. We want to negotiate wages. We don't want to have any mechanical device.

Unfortunately, the government does not have a majority without this splinter group. So there is some question as to whether they are going to be able to prevent another scare. And it's not entirely guaranteed. To some extent, it will depend on whether Mr. Bertinotti can be persuaded.

You know, I kept telling him that the reason workers lost is not because of the lack of escalator clauses, it's because he voted with the extreme right against the financial law. So it's his fault if the workers are worse off. And I think, from now on, when you vote, remember what effect this will have on the exchange rate. If you love workers, don't vote in a way that will produce devaluation.

Will he understand? No, he's too stupid, I'm afraid. I don't know. I don't really know whether he's stupid or not or just playing stupid. And maybe he can be persuaded.

In any event, you have a general idea of how this thing can work. It does rely--

By the way, the association of manufacturers, and in general, entrepreneur groups, large and small-- I have present here my nephew, Enrico Modigliani, who was the president of one of the local units of the young manufacturers. Right? That's right.

Oh, the small enterprise-- I'm sorry, yes. Yes, the association of manufacturers are small enterprises.

Anyway, in general these groups are in favor of the program. Okay? They want to see it work, because, for them, it means, on the one hand, lower interest rates-- so, opportunities to expand-- maintaining their markets, to some extent some squeeze on profits but not too serious, and--

So there is a will of, I think, a substantial group of those that matter. And, if they stick to something like this, I think Italy can come out so that, in two to three years, it will meet all the requirements of Maastricht that matter and be probably the first country to meet those requirements. Because it will have lower inflation and lower deficits than any other country.

And, with the entry, the lower interest rates can be assured. Because, by the time Italy is a member of the pact, Italian interest rates cannot be higher than German interest rates. You see, you have this great paradox. And when Italy was pushed out of the common market, the idea was that it might now be free to have lower interest rates, because, the exchange rate no longer being pegged, you could have lowered interest rates at the cost of devaluation.

What happened, in fact, is that interest rates stayed systematically higher. Why? Because of this terrible risk premium, the exchange risk. Okay? And so that some of it was inflation differential. Italy kept a somewhat high inflation rate. But, by the middle of this period, actually, the Germans were at even higher inflation. So it wasn't always one direction.

But some of it was inflation differential, but much of it was the risk premium, due to the exchange rates. And, as I said, we know that it is due to the exchange rates because, when the government of Italy issues bonds denominated in dollars or marks, the differential, instead of being 500 percentage points, is between 0.3 and 0.4, between 30 and 40. So, the risk of the country as such, or the risk of the government's solvency, is not regarded as large. It is simply that, if you invest in Italy, you're subject to great risk that Berlusconi will create another jump in exchange rate, and then you'll lose your shirt. Okay? Because you gain 2% on the interest rate, but you lose, in one month, at the rate of 20% per year or 30% per year.

So it is that exchange risk that says, I'm not going to buy Italian denominated instruments. Whether I am Italian or French makes no difference. I as an Italian am not going to invest in Italian instruments, because, when I think of what I could have in dollars, if there is a depreciation I would rather be in dollars.

So, essentially, that differential comes from the fear of depreciation of the exchange rate. Once you are in, and you've got [INAUDIBLE] exchanges, your rate should be within 30 or 40 basis points of the last. And, by that time, with the Italian miracle having been completed, maybe even the 30 points will disappear. And you've shown what you've been able to do. I think you deserve some credit for that.

So I would think that the problem of the deficit is cured. And, in fact, in a year or two, there will be a surplus. Because this huge primary surplus is not needed. Once interest rates are down to 4%, it's not needed. And so there will be finally a time where they will be able to cut taxes and spend more on important programs, including training programs and the like, which are very much lacking in Italy.

And, of course, Italy still has a huge problem, which is the south. Okay? Unemployment in the south is gigantic. There is, I think, what I call the-- I forget whose law. I think [? Baldassare's ?] law-- that says that, in Italy, in every region, women's unemployment is twice that of men. Okay?

So you start, from the north, unemployment of men 4%, women 8%. Then you take that and multiply by 1 and 1/2, and you get unemployment in the center. So, in the center, 4% becomes, I think, 6%. That's right. No, I think more than that-- about 10%. Yes. Women, the double.

And Then you get to the south, and you get 30%, or 25%, among men, and among women twice as much. Okay, now, that problem is still there, and that problem is going to be a hard one to solve, because it's really made complex by many, many problems.

And the unfortunate thing is that, in the south, people wait, without working, until they can get a post-office job. Because the post-office job is bliss. Right? If you get a post-office job, you don't work too much. And you get a nice pension when you retire, and you can start your pension at 55. It's a little changed, but it has been [INAUDIBLE] Italian scandals is the pension system.

Which, by the way, has been also almost fixed-- not quite, but huge step forward has been made, by Mr. Dini-- and the unions that have worked together. So, you know, in many ways, there is a sign of maturity that is very, very encouraging. And I think that maybe before my time is gone, Italy may be the first of the class. Thank you.

[APPLAUSE]